10 Best Trading Journals for 2025

- TraderVue

- TraderSync

- Edgewonk

- Trademetria

- TradeZella

- Journalytix

- Profit.ly

- E*Trade

- Microsoft Excel / Google Sheets

- Notion Trading

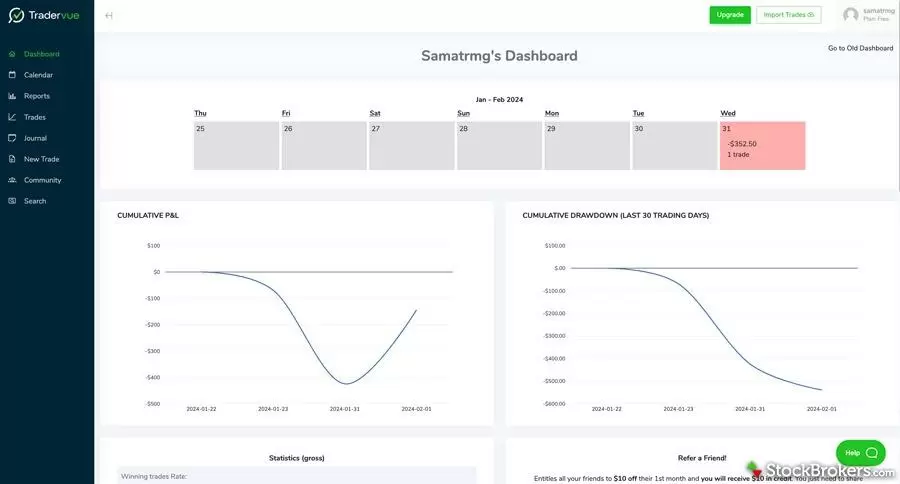

Strengths: Advanced analytics, broker integrations, social sharing.

Best for: Active day traders, professional users.

Pricing: Free basic tier; premium starts at $29/mo.

Overview

TraderVue has built a loyal user base since its early days and remains a solid option for active traders who value detailed analytics.

While its interface might feel a bit dated compared to newer platforms, it shines when it comes to features like auto-generated charts marking entry and exit points.

Broker import support is strongest for high-volume platforms favored by day traders. New users may face a slight learning curve, but the depth of insights available makes it worthwhile.

Strengths: intuitive UI, trade replay, powerful filtering.

Best for: Beginners to advanced traders.

Pricing: Starts at $29.95/mo.

Overview

TraderSync blends functionality with a modern design that’s welcoming even to beginners.

Its intuitive layout allows traders to quickly log trades, tag setups, and use features like trade replay for deeper learning.

The platform stands out with its performance analytics and customizable filters. While not the cheapest tool on the market, its comprehensive feature set justifies the price for most serious traders.

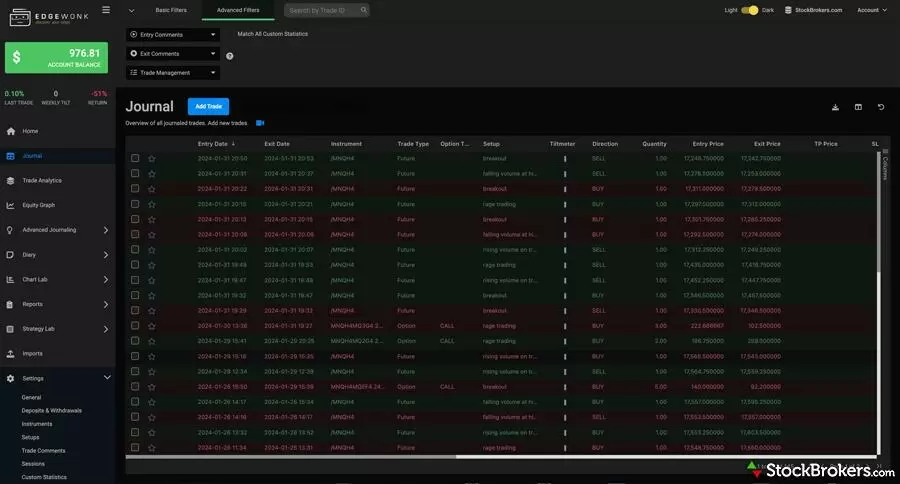

Strengths: Custom metrics, emotional tagging, detailed performance reports.

Best for: Swing traders, discretionary traders.

Pricing: One-time payment ($169 lifetime).

Overview

Edgewonk takes a data-driven approach to journaling, offering custom metrics and deep insights into trader psychology.

It’s a downloadable application rather than cloud-based, which some may find limiting.

However, its structured layout and emotional tagging features are especially useful for swing traders and discretionary investors looking to refine their edge.

The one-time pricing model also appeals to those who prefer not to deal with subscriptions.

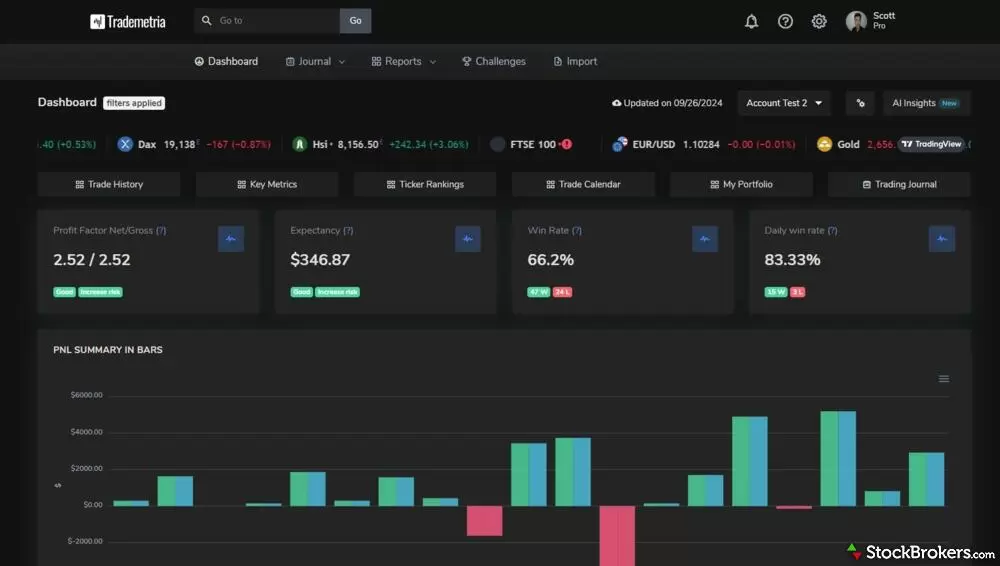

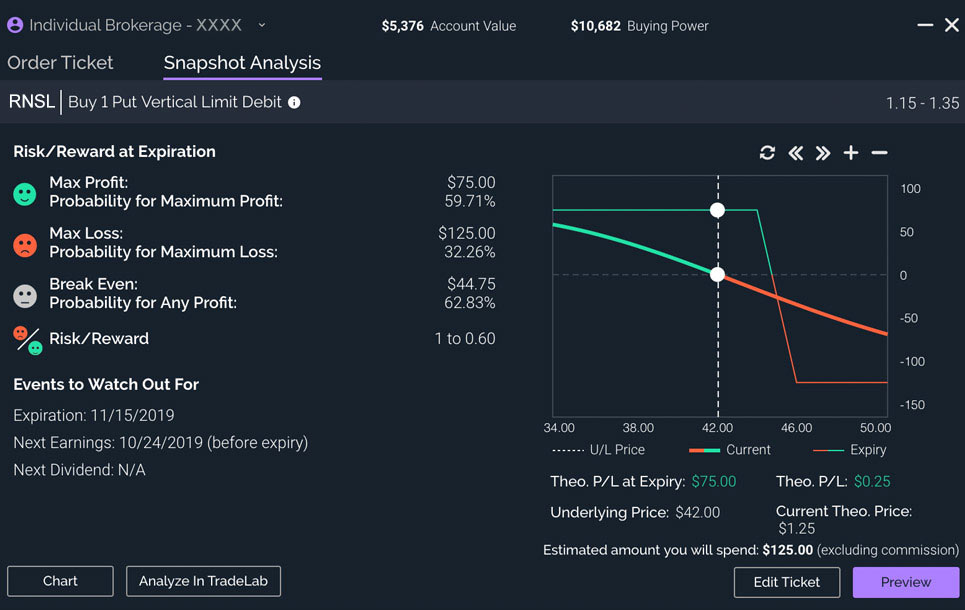

Strengths: Performance summary, trade journal, risk analysis tools.

Best for: Traders seeking simplicity with depth.

Pricing: Free plan available; Pro starts at $29.95/mo.

Overview

Trademetria strikes a nice balance between simplicity and functionality.

It offers a clean interface, key performance summaries, and essential tools like risk tracking and portfolio analytics.

Though its analytics may not be as deep as some competitors, the platform is ideal for newer traders or those who prefer a lightweight, web-based solution without unnecessary bells and whistles.

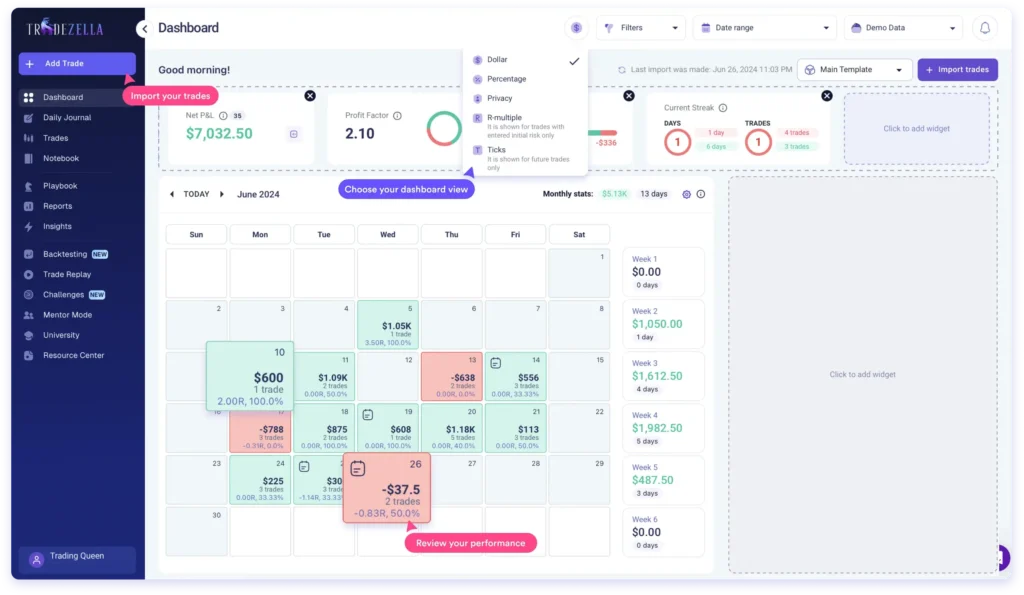

Strengths: Clean UI, psychology tracking, trade breakdowns.

Best for: Psychology-focused journaling.

Pricing: Starts at $49.99/mo.

Overview

TradeZella is one of the newer players but has gained attention quickly due to its slick design and focus on trader psychology.

The platform lets users journal trades, analyze emotional decisions, and visualize performance in an easy-to-navigate dashboard.

It’s best suited for traders who want an engaging, reflective journaling experience.

The price point may be high for some, but it delivers on its promise of clarity and self-awareness.

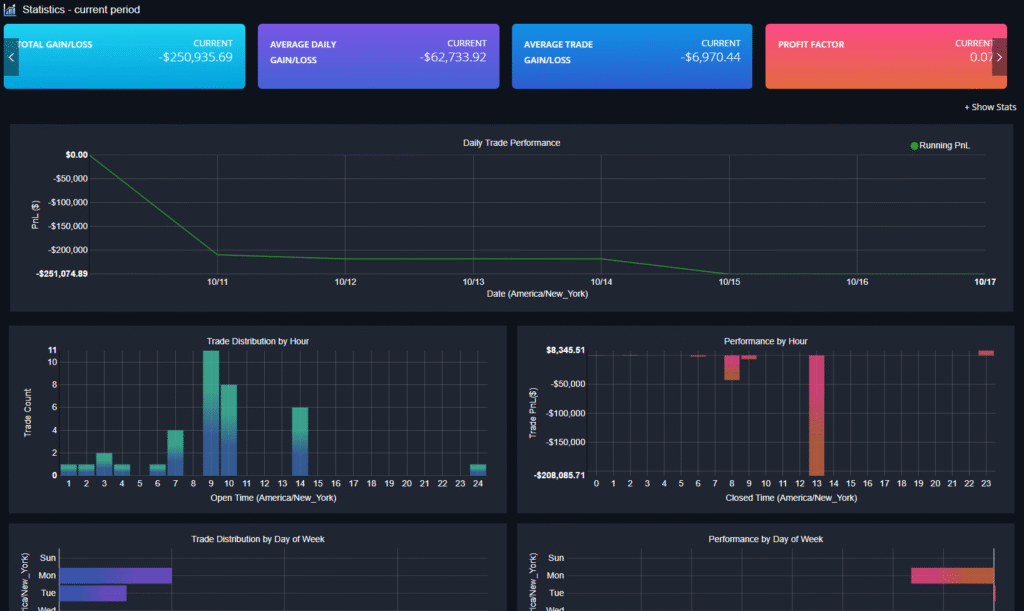

Strengths: Live journaling, chat integration, real-time analytics.

Best for: Traders who want real-time feedback and automation.

Pricing: $47/month.

Overview

Journalytix offers a unique take on journaling with live trade tracking, team chat features, and real-time performance feedback.

This makes it appealing for professional desks or highly active traders.

Its interface can feel overwhelming at first, and the feature-rich environment might be too much for casual users.

But for those seeking detailed real-time tracking and communication tools, it’s hard to beat.

Strengths: Social features, trade transparency, leaderboard.

Best for: Community-driven journaling, followers of Timothy Sykes.

Pricing: Tiered plans, starting around $29/mo.

Overview

Profit.ly focuses heavily on community and transparency.

It allows users to publish trades publicly, learn from peers, and even gain followers.

While the platform is tied closely to the trading style of Timothy Sykes, it provides a solid journaling foundation for traders who benefit from social motivation.

It’s not the most feature-rich analytically, but it’s a great fit for those who want to build accountability through public tracking.

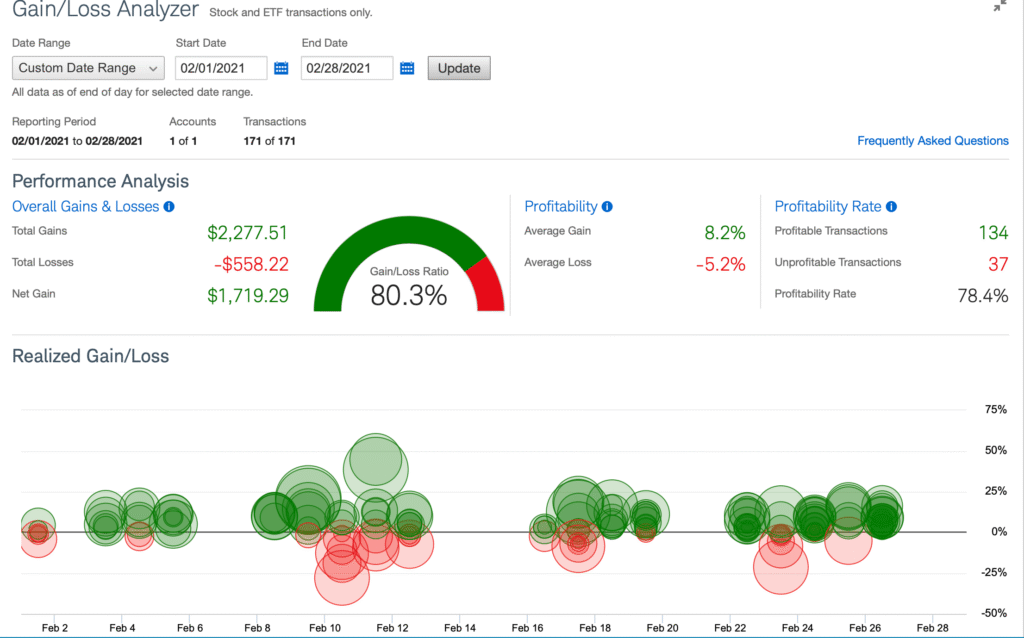

Strengths: Built into E*TRADE platform, easy to use.

Best for: E*TRADE customers who want basic journaling.

Pricing: Free with brokerage account.

Overview

For those already trading through ETRADE, the built-in Power ETRADE journal tool is a handy perk.

It integrates directly into the platform and provides a basic overview of trading activity.

While it lacks advanced tagging or psychology-focused features, its ease of access makes it ideal for casual traders who want a quick and no-fuss solution.

Strengths: Fully customisable, no subscription.

Best for: Traders who prefer DIY, spreadsheet-savvy users.

Pricing: Free.

Overview

Spreadsheets remain a go-to journaling method for traders who want full control over their data.

With enough customization, Excel or Google Sheets can rival paid tools, though they require manual input and more effort to maintain.

For traders who enjoy building custom reports and dashboards or who simply want a free solution this approach remains as relevant as ever.

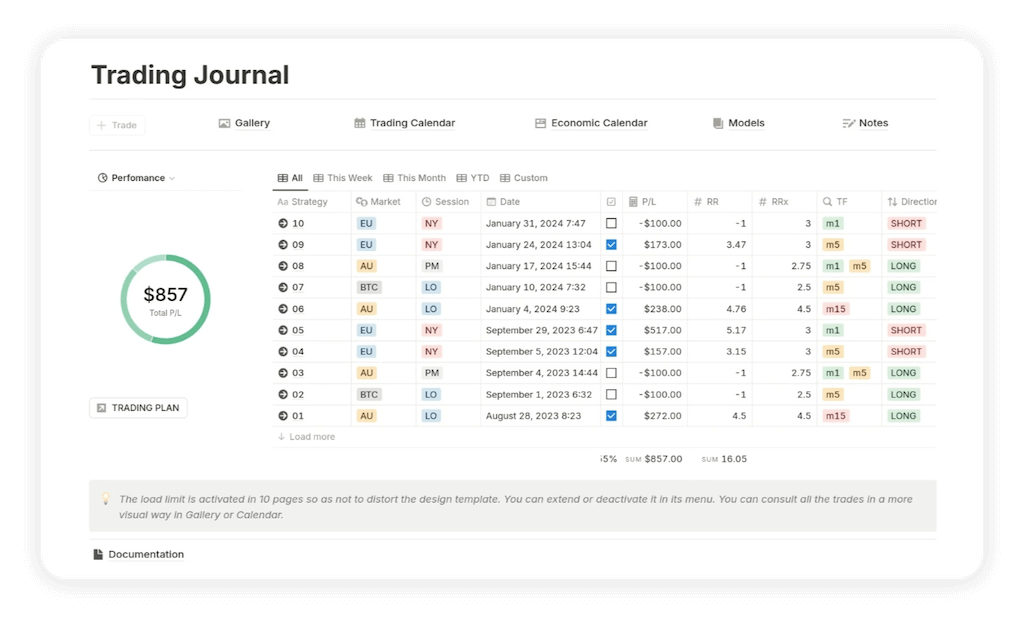

Strengths: Visual, all-in-one workspace, notes + trades.

Best for: Tech-savvy traders who prefer Notion.

Pricing: Free with optional upgrades.

Overview

Notion has gained popularity among traders who like to combine journaling, research, and note-taking in one place.

It’s flexible and visually appealing, but doesn’t come with pre-built trading analytics.

Ideal for those who already use Notion for productivity, it allows for a personalised and creative journaling experience especially when paired with databases and templates.