A trading journal is a way to record, review, and improve every trade you make. It captures key information – your entry and exit points, position size, and your mindset at the time of each decision. Whether you trade forex, a commodity, or an index, keeping a journal helps you identify patterns in your results and refine your trading strategies over time.

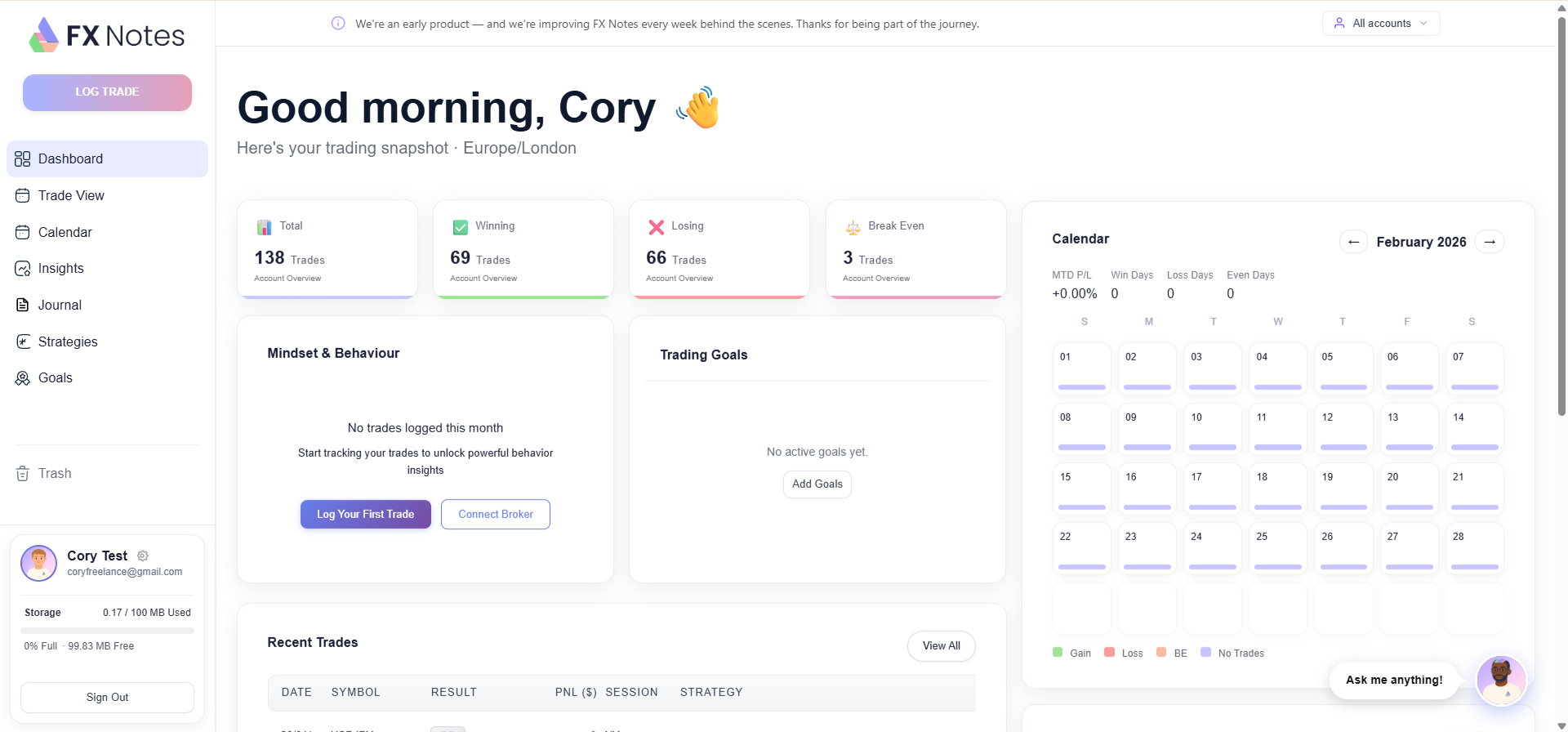

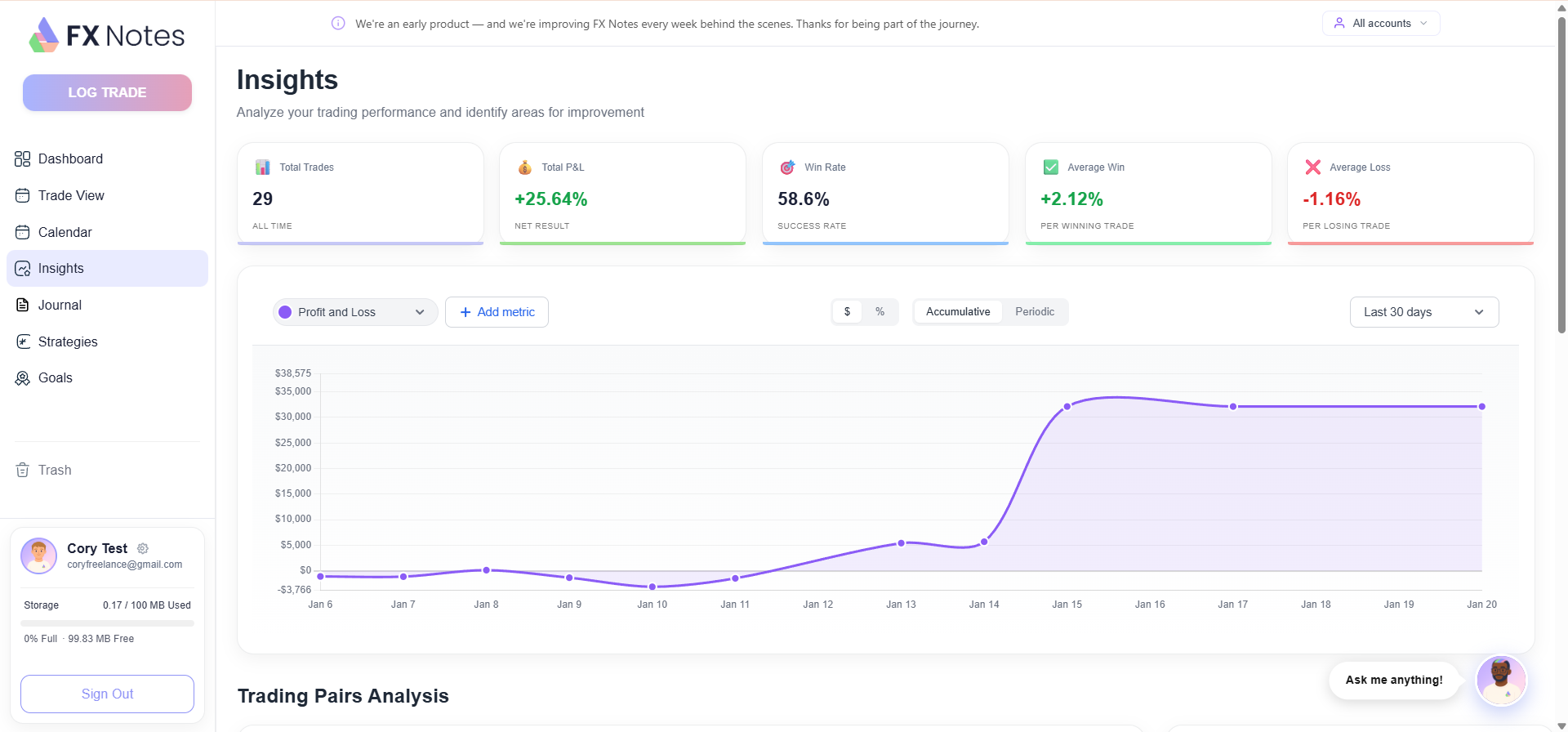

Here at FX Notes, we’ve built an AI-powered forex trading journal that lets you do all of this in a single click. Our platform analyses your trading performance automatically and shows you exactly what’s working and what isn’t.

A trading journal isn’t just a record of past results – it’s a roadmap for becoming a better trader. Every successful trader keeps one because it turns raw data into real, actionable intelligence. In this guide, we’ll walk you through what a trading journal actually includes, how to use a trading journal effectively, and why FX Notes is the best trading journal for anyone who wants to improve your trading without spending hours on manual recording.

Why Should You Keep A Trading Journal?

▼Because it’s the fastest way to track what’s actually happening in your trades – and to hold yourself accountable for every decision. Without a written record, you’re relying on memory, and memory is unreliable, especially after a string of losing trades.

Every trader reaches a point where instinct alone isn’t enough. A trading journal forces you to slow down, review your trading decisions, and separate emotion from fact. It’s a learning process that turns scattered observations into structured insights you can act on.

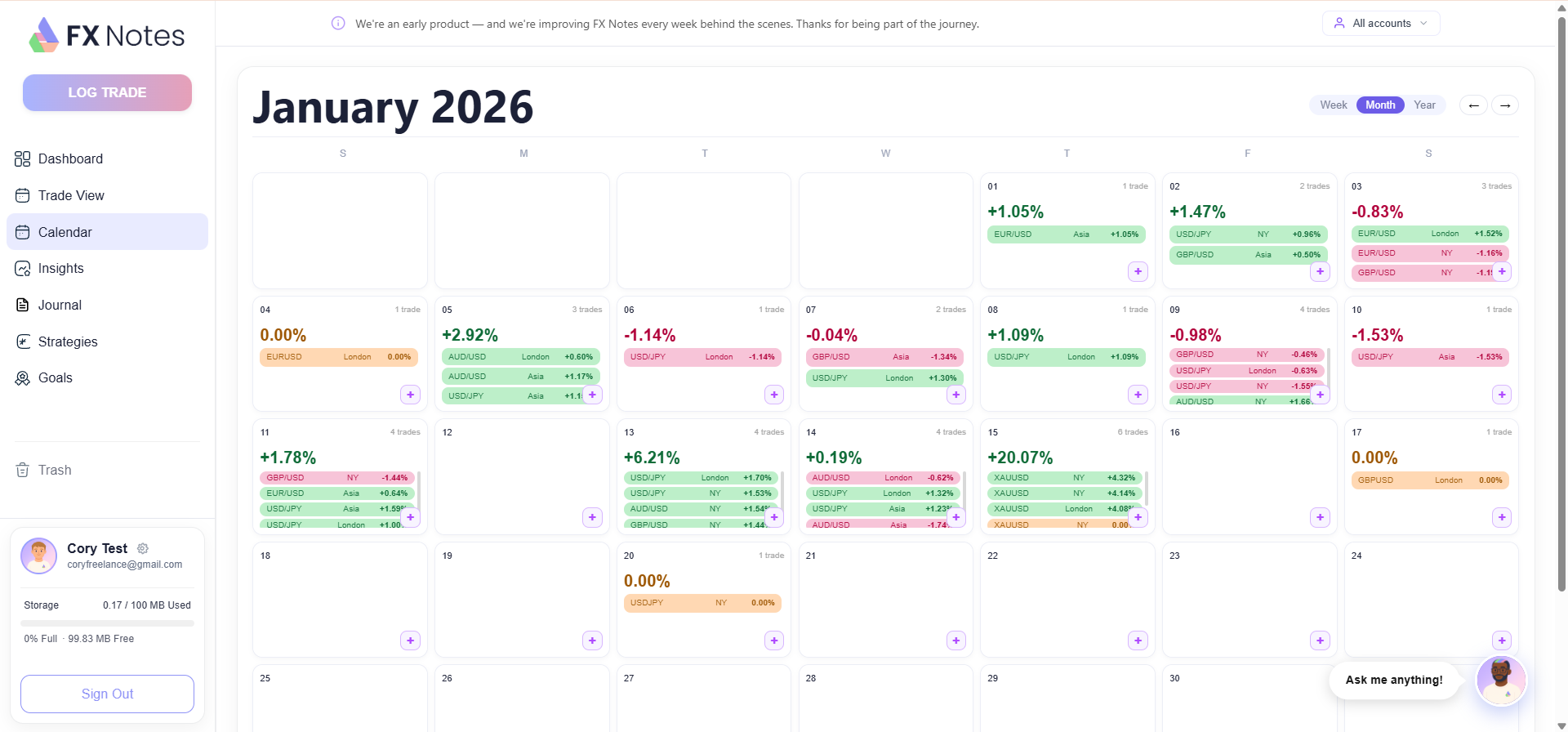

When you log your trades consistently, you’ll start noticing recurring behaviours. Maybe you’re overtrading during volatile sessions, or maybe your best results come from one specific setup. Without a journal, those patterns stay hidden. With one, they become the foundation for smarter trade decisions.

The Accountability Factor

There’s another benefit that often gets overlooked: accountability. Writing down your reasoning before and after a trade creates a feedback loop. You’ll quickly see whether you’re following your trading plan or drifting away from it. That kind of honesty is what separates traders who plateau from those who keep improving.

What Should You Record In Every Trade?

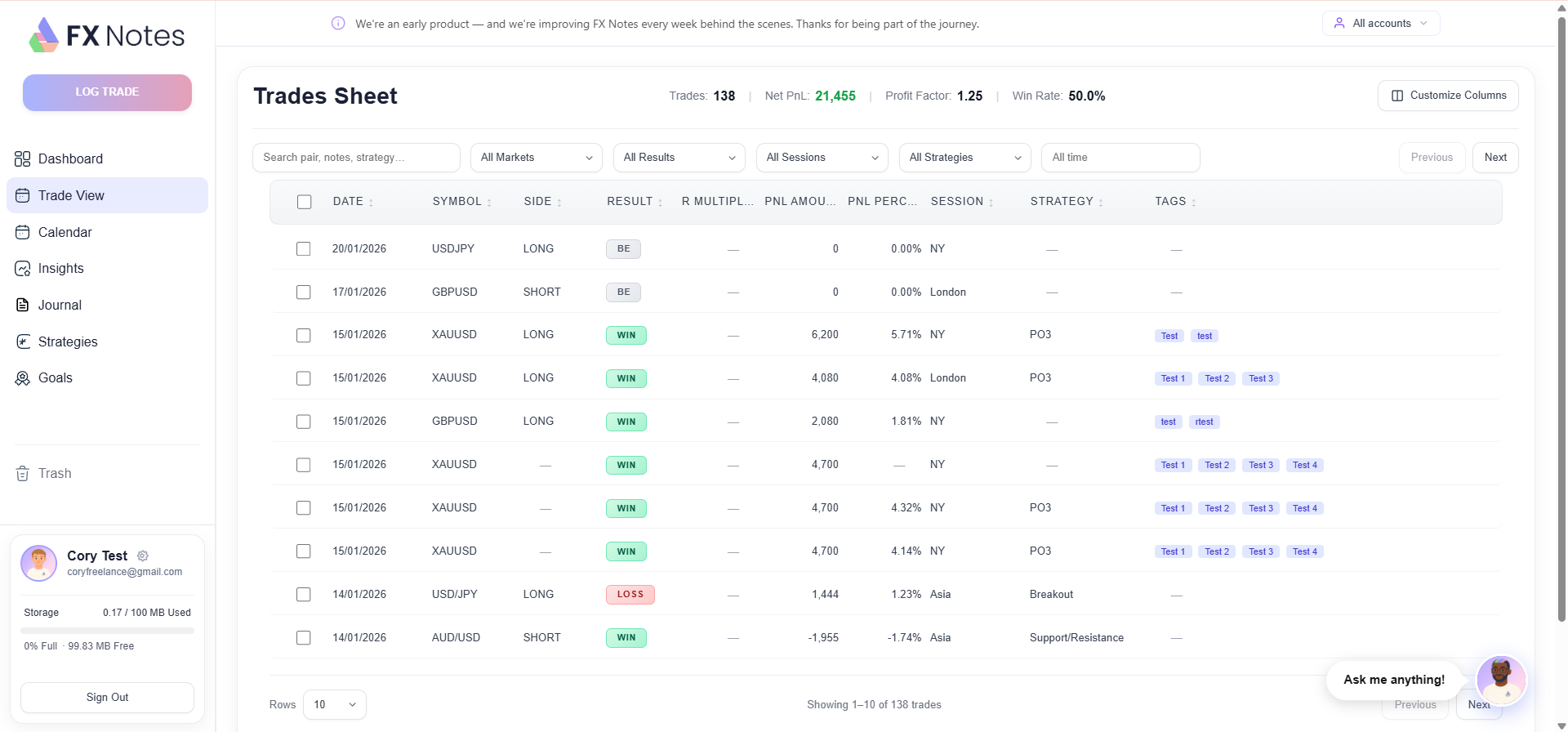

▼At minimum, record the date and time of each trade, the asset (whether that’s a currency pair, commodity, or index), your entry point and exit, position size, and whether the trade was a win or loss. That’s your baseline – but the real value comes from going deeper.

Your emotional state matters – were you confident, anxious, or revenge-trading after a loss? Your reasoning matters – what setup did you see, and why did you enter? And your post-trade analysis matters – with hindsight, would you take the same trade again? Recording your trades with this level of detail turns a simple list into something genuinely useful.

How FX Notes Handles This Automatically

At FX Notes, our trading journal captures this automatically. All in one click, you can record, review, and improve – no need to manually fill in a spreadsheet after every session. The system tracks your trading activity and maps it against your own notes, giving you a complete picture without the admin overhead.

How Do You Create A Trading Journal?

▼You’ve got three main options: a spreadsheet, a physical notebook, or dedicated trading journal software. Each approach has trade-offs, and the right choice depends on how much time you’re willing to spend on admin versus actual analysis.

A spreadsheet gives you full control – you can build custom columns, formulas, and a chart. But it requires manual input for every single trade, and most traders find the friction means they stop after a few weeks. A physical notebook is great for personal reflection but terrible for number-crunching.

Why Dedicated Software Removes The Friction

Purpose-built tools like FX Notes remove that friction entirely. You connect your broker, and your trades are imported automatically. From there, you can tag trade setups, add notes, and review your results without touching a cell. Many trading platforms offer basic tracking, but a dedicated journal goes much deeper – giving you the tools to analyse trends across different timeframes and measure your improvement over time.

How Does A Trading Journal Help You Find Patterns?

▼When you’ve been recording trades for a while, you can start to analyse your data for patterns you’d never notice in real time. This is where journaling transforms from simple record-keeping into genuine edge-building.

For example, you might discover that your win rate drops when you place trades at certain times of the day. Or that your losing trades cluster around specific market conditions. Maybe certain market movements trigger emotional reactions that cost you money. These insights only emerge when you’ve got weeks or months of data to review.

AI-Powered Pattern Recognition With FX Notes

FX Notes takes this further with AI-powered analytics. Our system automatically surfaces patterns in your results – highlighting your strengths and weaknesses, your most profitable setups, and the conditions where your edge is strongest. It’s like having a coach who reviews your trade results after every single session, helping you spot exactly where to focus next.

What Makes Great Trading Journal Software?

▼The right tool depends on your trading style and what you need most. Edgewonk is a popular option known for detailed performance data. Tradervue offers solid importing and community features. Some traders prefer a simpler approach.

But if you want something that combines automatic trade capture with AI-driven analysis, FX Notes is purpose-built for exactly that. All in one click, you can record, review, and improve. Our products and services cover forex, commodity, and cryptocurrency trading – so whatever market you’re active in, the journal adapts to you.

What To Look For When Choosing An App

When evaluating a trading journal app, look for automatic broker imports (so you’re not manually entering each trade), built-in analytics that go beyond basic profit and loss, and a clean interface that doesn’t create more work than it saves. The whole point of a journal is to make the review process easier, not harder.

Can You Use A Spreadsheet As A Trading Journal?

▼Yes – and many traders start there. A well-built trading journal template can track everything from your entries and exits to your risk management targets. You can add formulas for win rate, risk-reward ratio, and running profit and loss.

The trade-off is time. Manually logging trades after every session adds friction to your trading process, and friction is the enemy of consistency. Too much of it and the whole thing falls apart. That’s exactly why many traders eventually move to a dedicated tool like FX Notes – the automation removes the admin, so you can focus on reviewing your data and improving with every trade.

How Often Should You Review Your Trading Journal?

▼After every session – even if it’s just a quick note on what went right and what didn’t. Then once a week, sit down and look at the bigger picture to evaluate your progress.

That quick daily review keeps you honest and builds good habits. The weekly review is where you’ll notice broader trends: did your risk tolerance hold up? Are you improving in the areas you identified last week? These are the kinds of questions that turn a simple record into a genuine tool for growth.

Check Your Results At Any Level With FX Notes

With FX Notes, you can review your performance at any level of detail. Our insights dashboard shows daily, weekly, and monthly trends – helping you see what’s working without having to crunch numbers yourself. You can check whether you trade better at certain times, with certain setups, or during certain conditions, and use that data to refine how you approach each trade.

Why Choose FX Notes For Online Trading?

▼We built FX Notes because existing options weren’t good enough. Most journals are either too basic – just a glorified trade log – or too complex, creating more work than the trading itself.

FX Notes is an AI-powered tool for traders who want to improve without drowning in admin. Trade capture happens automatically. The insights are specific to your trades – not generic advice, but data-driven observations drawn from your actual trading.

Whether you’re an intraday scalper, a swing trader, or a longer-term investor, FX Notes gives you the clarity to avoid repeating mistakes and double down on what works. Effective trading comes from knowing yourself as well as you know the market – and that’s exactly what keeping a trading journal delivers.

Ready to see the difference?

All in one click, you can record, review, and improve. Start with our free plan and see how a trading journal can transform your results.