The forex market is the largest financial market in the world, and the many benefits of forex trading make it a popular choice for traders globally. Whether forex is your first market or you already trade stock, the advantages of forex trading are clear. Forex is the most liquid market in the world, it is open 24 hours a day, and it provides the ability to trade on margin with flexible leverage. At FX Notes, we help every trader record, review and improve each trade they make – and in this guide, we explore the main benefits, the risks, and how to start trading forex with confidence.

The forex market offers opportunity at every level, from a beginner opening a first demo account to a successful forex trader managing complex positions. Understanding the advantages of trading forex will help you decide if this is the right market for your goals. Below, we cover the benefits of trading forex, the disadvantages of forex trading you should know about, and what makes this market so attractive to millions of traders worldwide.

Forex Is a Truly Global Market

▼

The foreign exchange market is a decentralised marketplace that connects every major financial centre. Unlike the stock market, which is tied to specific market hours, forex markets are open around the clock, five days a week. This means you can trade the forex market whenever it suits your schedule.

Forex is an over-the-counter market, and the majority of forex trading takes place electronically. Forex trading is concentrated across four major sessions – Sydney, Tokyo, London and New York. Each session brings different active session’s forex trading hours and levels of price volatility in forex, giving you flexibility based on your trading style.

Around-the-Clock Access

It is important to remember that the forex market’s opening hours mean there is almost always a chance to trade, regardless of where you are. This around-the-clock access is one of the biggest advantages compared to exchanges where schedules are fixed. Forex trading is available almost every weekday, so you rarely miss a trade because the market was closed.

High Liquidity and Tight Spreads

▼

High liquidity is one of the key reasons traders prefer forex. The size of the forex market ensures there are always buyers and sellers, so your forex transactions are completed quickly at prices close to what you expect. This is especially true for EUR/USD, GBP/USD and USD/JPY, which would be the major forex pairs seeing the largest trading volume.

Deep liquidity also means tighter spreads – the difference between the buy and sell price of a forex pair. Tighter spreads reduce the cost of each trade, which matters whether you place a handful of currency trades per week or dozens per day. Compare this to other financial markets where wider spreads eat into profitability on every trade you take. Over hundreds of trades, the difference in cost can be significant.

Leverage and Trading on Margin

▼

Leverage in forex allows you to control a larger position with a smaller amount of capital, meaning you do not need a huge trading account to get started. Many forex brokers offer leverage ratios that amplify your exposure, allowing you to trade with more capital than you deposit.

For example, with 10:1 leverage, a deposit of $1,000 gives you control of a $10,000 position, meaning even small price movements can generate meaningful returns on your trade.

Risk Warning

However, high leverage also means high risk. Leveraged forex positions can result in losses that exceed your deposit, and there is a high risk of losing money if you do not manage each trade carefully. This is why risk management should sit at the core of every trade you take. Never enter a trade without knowing your maximum downside.

At FX Notes, our trading journal helps you track how leverage affects your results across every trade, so you can find the right balance between opportunity and risk.

Flexibility to Trade in Any Direction

▼

Unlike stock investments where you primarily profit when prices rise, forex trading gives you the freedom to trade in both directions. You can go long if you believe a forex pair’s price will rise, or go short if you expect it to fall. This means there are trading opportunities in both rising and falling markets.

A forex trader can look to profit from price movement regardless of the trend. Understanding the future direction of a forex pair’s movement is what separates consistent traders from those who struggle. The highly volatile forex market creates frequent chances to trade, but it is important to consider the risks involved in each trade you enter.

Hedging with Forex

You can also use forex to hedge forex exposure from other investments. Choosing forex pairs that are positively or negatively correlated can protect against unwanted moves in the forex market. This flexibility is something many traders value highly.

Low Barriers for Beginners

▼

Compared to other markets, forex is less regulated in terms of minimum capital requirements. You can open a forex trading account with a relatively small deposit, and most brokers offer a demo account so you can practise without risking real money. This low entry point makes forex accessible to traders at every stage.

A demo account lets you try forex trading in live conditions, test your trading strategies and get familiar with your trading platform and trading app before committing capital. Most forex platforms also provide educational resources to help you develop as a trader. Taking the time to practise before going live is one of the smartest decisions any new trader can make.

The easiest forex pair to trade for new traders is typically EUR/USD, thanks to tight spreads and deep liquidity. Whether you want to start trading with a small account or scale up over time, the currency market has a low barrier to entry that few other markets can match.

Forex vs Stocks

▼

When comparing forex and stock markets, several key differences stand out. The market is open 24 hours compared to fixed exchange hours, and forex provides more frequent price movements that active traders can capitalise on. Forex offers a larger trading volume than any stock exchange, meaning better fills and less slippage on your forex trades.

Equity trading can offer long-term trading returns through company ownership and dividends, but forex is preferred by traders who want short-term flexibility and the freedom to trade around the clock. That said, both markets carry high risk, and many traders trade stock alongside forex as part of a diversified approach. There is no single right answer – it depends on your goals and how you prefer to trade.

Key Risks and Disadvantages

▼

Forex trading include real dangers that every trader must understand before opening a live account. Most retail accounts lose money, particularly when using excessive leverage without proper risk management. Losses can build quickly, and every trade you enter carries risk.

Regulation varies by region, so choosing a reputable forex broker is essential. Always trade with a regulated broker, and never risk more than you can afford to lose. If a trade goes against you, proper stop losses can limit the damage and protect your capital. Risk management is not optional – it is the foundation of every successful approach to the markets.

It is also worth noting that not every trade will be profitable. Even experienced traders have losing periods. What matters is how you manage each trade and what you learn from the outcome. A consistent process, clear rules and honest review of your trade history will serve you far better than chasing quick profits.

Discover the Advantages of Forex with FX Notes

▼

Forex is a marketplace for trading that attracts millions worldwide. But these advantages only matter if you have the tools to act on them.

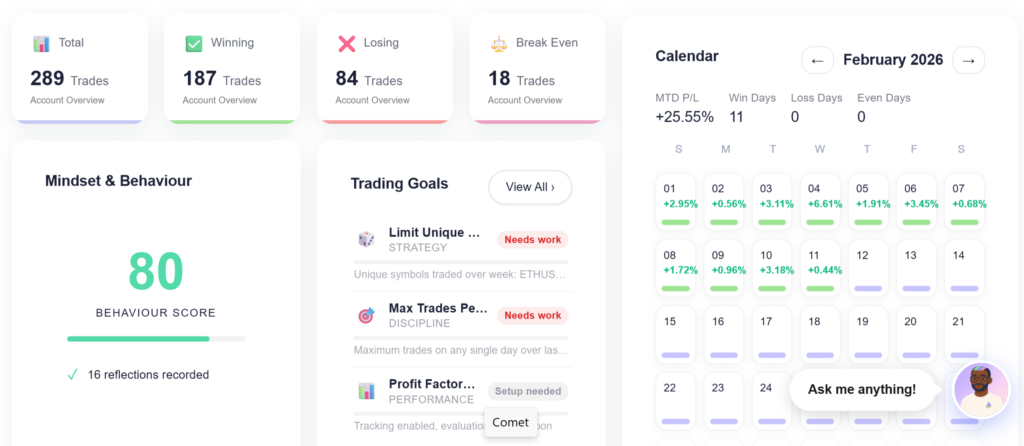

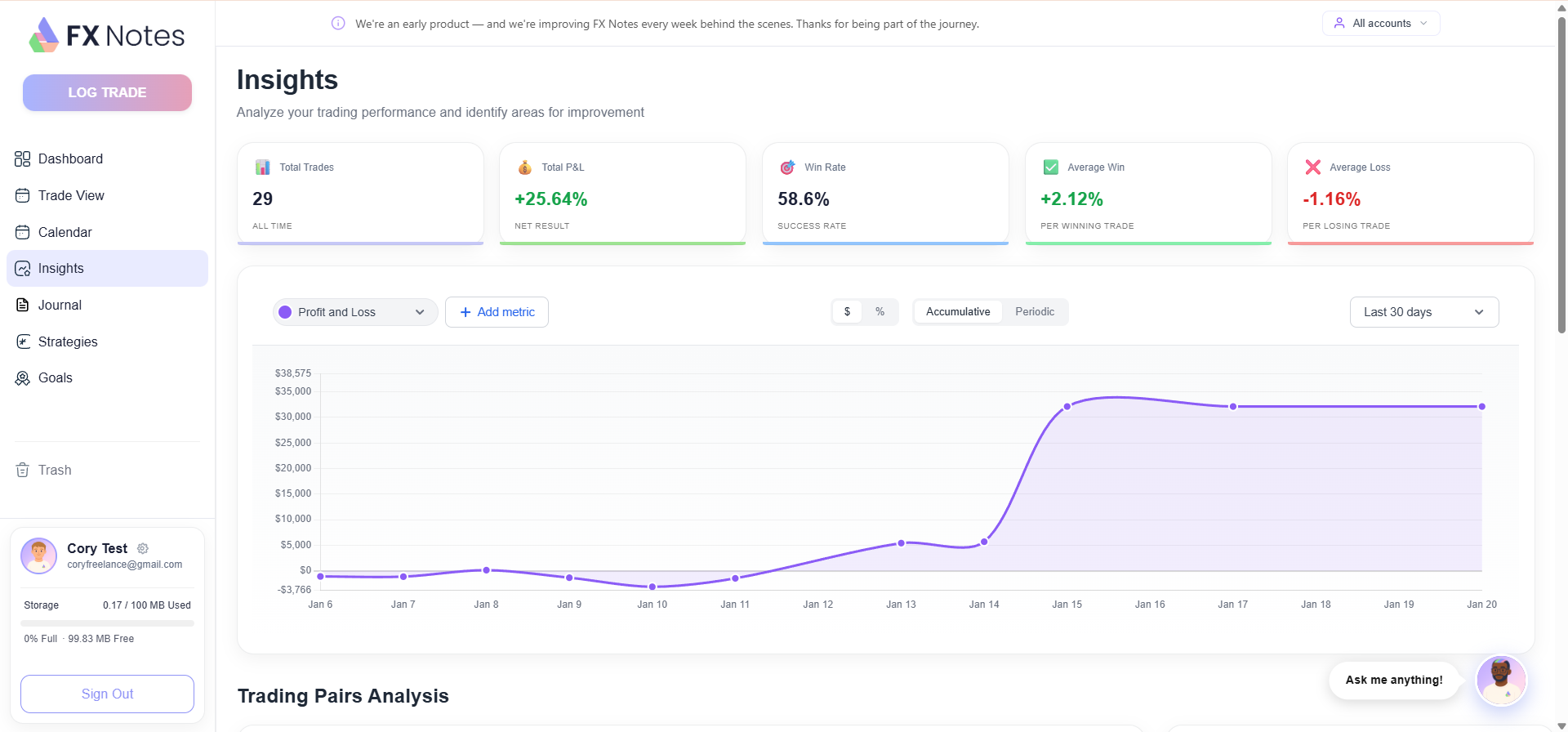

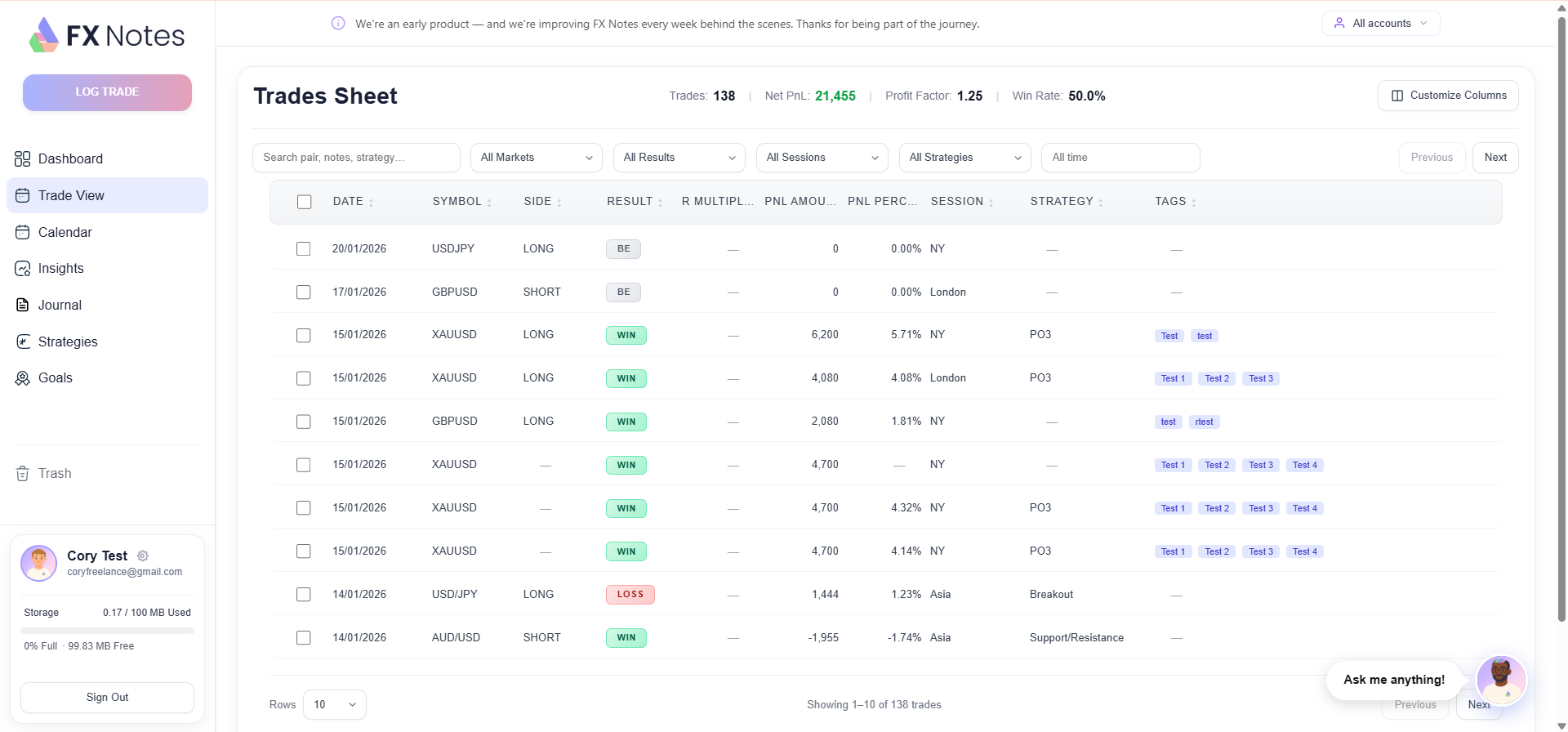

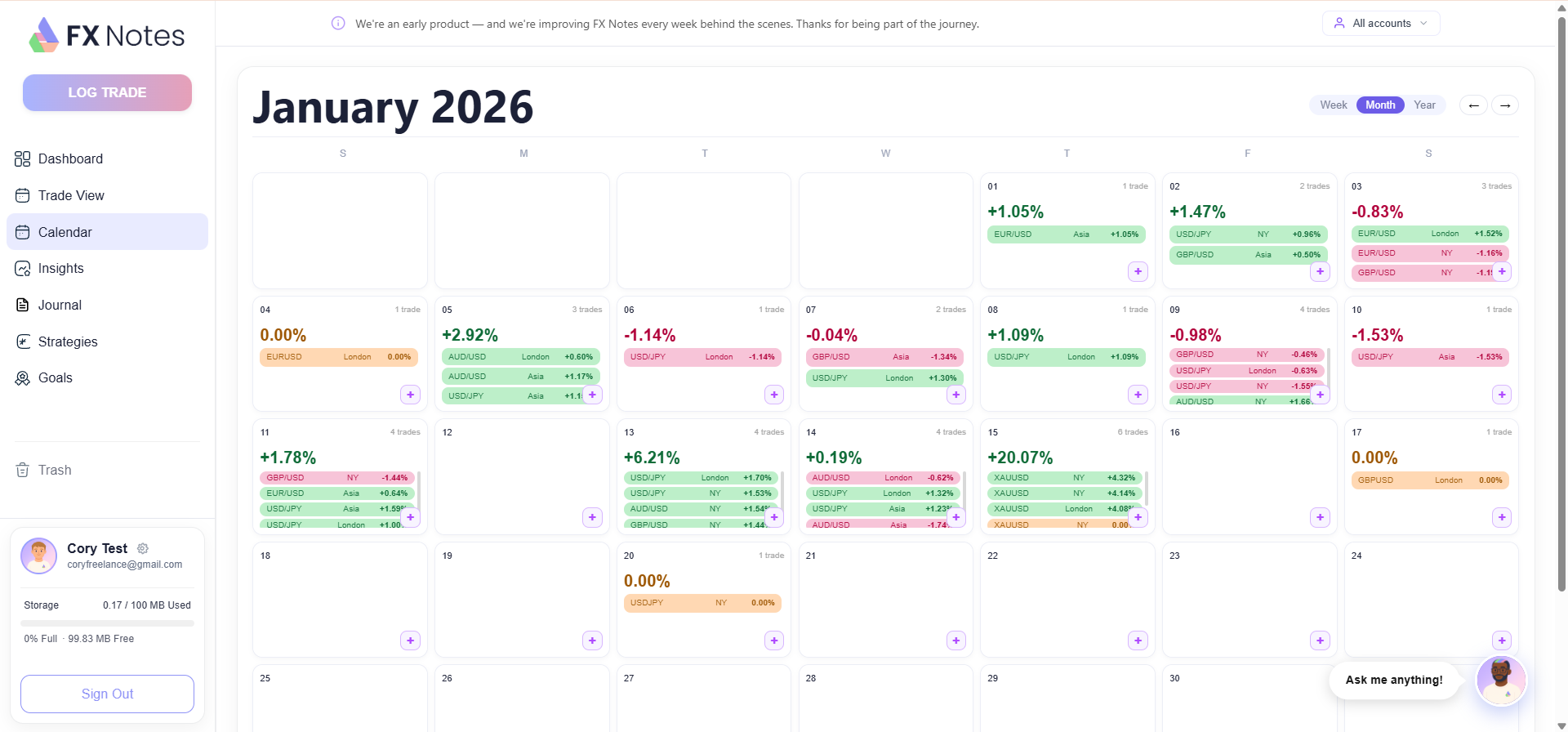

At FX Notes, we built our AI-powered journal to help every trader track, analyse and improve their trade performance. Whether you trade forex, crypto or stock, our platform logs every trade with full detail, highlights patterns and helps you make data-driven decisions. After each trade, you can review what happened, why you entered, and how the trade played out – giving you the insight to improve over time.

You’ll trade forex more effectively when you can see exactly which sessions and strategies deliver your best results. Every trade is a learning opportunity, and a proper journal turns raw data into real progress. If you are ready to choose forex trading as your preferred market, start your trading journey with FX Notes today.

Ready to improve your forex trading?

All in one click, you can record, review, and improve. Start journaling and see the difference data-driven trading makes.