Forex trading is the buying and selling of currencies on the foreign exchange market – the largest and most liquid financial market in the world. Also known as forex or FX, this global currency market sees over $7 trillion in daily trading volume, dwarfing every stock exchange combined. Forex trading involves exchanging one currency for another at an agreed market price, and the forex market is open 24 hours a day, five days a week. Whether you want to trade forex as a full-time career or simply learn what forex trading is all about, this guide covers how the market works, the strategies traders use, and how to start trading forex with confidence.

At FX Notes, we help traders of all levels record, review and improve every trade they make. Our AI-powered trading journal is designed to support anyone looking to trade currencies more effectively – from beginners taking their first steps to experienced traders refining advanced trading strategies. In this article, we break down how the foreign exchange market operates, what drives exchange rate movements, and the different ways to trade forex so you can make informed trading decisions from day one.

How Does Forex Trading Work?

▼Forex trading works like any other exchange where assets are bought and sold. When you place a forex trade, you are simultaneously buying one currency and selling another. Currencies are always quoted in pairs – for example, EUR/USD or GBP/JPY. A forex pair is a combination of two currencies, where the first is the base currency and the second is the quote currency. The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency.

The foreign exchange market is a global, decentralised network. Unlike stock exchanges, there is no single physical location where forex is traded. Instead, it operates as a network of banks, institutions, forex brokers and individual traders connected electronically. This is what makes forex unique – the market is open 24 hours a day across different trading sessions in London, New York, Tokyo and Sydney. When one session closes, another opens, creating a continuous 24-hour trading cycle that offers flexibility no other market for trading currencies can match.

The Spot Market and Other Forex Products

The spot market is where most retail foreign exchange trading takes place. In spot forex, currencies are bought and sold at the current market price for immediate delivery. This is the most straightforward approach to the trading of currencies, and it is what most people mean when they talk about forex.

Beyond spot forex, there are additional ways to trade forex including futures contracts and CFDs (contracts for difference). Futures are agreements to buy or sell a currency at a set price on a future date, while CFDs let you speculate on forex prices without owning the underlying market asset. It is important to understand how CFDs work and whether they suit your risk appetite, as a significant percentage of retail investor accounts lose money when trading CFDs with leveraged trading products.

There are also different forex products such as options and forwards, which are more commonly used by institutions and businesses to hedge forex exposure rather than for speculative trading.

How the Forex Market Works

▼Understanding how financial markets work – and how FX markets work in particular – is essential before you place your first trade. The currency market is driven by several key forces that cause exchange rates to rise and fall.

Supply and Demand

At its core, every currency trade is governed by supply and demand. When demand for a currency rises – because of strong economic data, for example – its price increases relative to other currencies. When demand falls, so does its value. This constant push and pull between buyers and sellers is what creates trading opportunities across every forex pair.

Interest Rates and Central Banks

Interest rate decisions are among the most powerful drivers of forex market moves. When a country’s central bank raises its interest rate, that currency typically strengthens because higher rates attract foreign investment. Conversely, lower interest rates tend to weaken a currency. Traders closely watch interest rate announcements to anticipate how exchange rates might shift.

Market Sentiment and the Carry Trade

Market sentiment reflects the overall mood of market participants toward a currency or the broader FX market. Positive sentiment can drive prices higher even in the absence of fundamental change, while negative sentiment can trigger sharp sell-offs. News trading is a strategy built around reacting to major economic releases or unexpected data that shifts sentiment rapidly.

The carry trade is a popular forex strategy where a trader borrows in a low-interest-rate currency and invests in a higher-yielding one, profiting from the interest rate differential. The carry trade can be profitable in stable market conditions but carries risk if market sentiment shifts suddenly.

Market Participants

The forex market is made up of a wide range of participants. Central banks, commercial banks, hedge funds, corporations and retail traders all play a role. Market makers – typically large banks – provide liquidity by quoting both buy and sell prices, ensuring the currency market stays active and accessible. Retail traders like you and us access the market through forex providers and forex brokers who connect us to this global network.

Types of Forex Trading Strategies

▼One of the first things to understand is that there is no single “right” way to trade. Your approach will depend on your schedule, risk tolerance and trading style. Here are the most common trading strategies used by forex traders around the world.

Day Trading

Day trading involves opening and closing positions within the same session. Traders using this approach aim to profit from short-term market price movements and typically do not hold trades overnight. This style requires close attention to charts used in forex trading and quick decision-making during active hours. While there is plenty of trading advice online about this approach, the reality is that it demands discipline and a proven system.

Swing Trading

Swing trading takes a slightly longer view, with traders holding positions for several days or even weeks. This strategy looks to capture larger market moves and relies heavily on technical analysis to identify entry and exit points. It suits traders who cannot monitor the market every hour but still want to actively trade forex.

Scalping and Short-Term FX Trading

Scalping is a high-frequency strategy where traders aim to capture very small price movements multiple times throughout the trading session. It demands fast execution and a reliable platform. While scalping can be profitable, it requires discipline and a solid understanding of how currency markets work.

Position Trading and Long-Term Strategies

Position trading is closer to investing and trading over the long term, where traders hold positions for weeks, months or even longer. This style focuses on macroeconomic trends, interest rate cycles and broader conditions rather than short-term noise.

Understanding Forex Pairs and Exchange Rates

▼Every forex trade involves a forex pair – two currencies quoted against each other. Forex pairs are grouped into three main categories.

Major forex pairs include EUR/USD, GBP/USD, USD/JPY and USD/CHF. These involve the world’s most traded currencies and tend to have the tightest spreads and highest trading volume. If you are trading the euro against the US dollar, for example, you are trading the most popular forex pair in the world.

Minor pairs do not include the US dollar but feature other major currencies, such as EUR/GBP or AUD/JPY. Exotic pairs combine a major currency with one from a developing economy.

Exchange rates fluctuate constantly based on economic data, interest rate expectations, political events and market sentiment. Learning to read and interpret exchange rate movements is a fundamental skill for any forex trader looking to trade profitably.

How to Start Forex Trading

▼If you are ready to start forex trading, there are several steps to follow to set yourself up for success.

1. Choose a Forex Broker

Your forex broker is your gateway to the foreign exchange. Look for a broker regulated by a reputable authority such as the FCA, ASIC or the Commodity Futures Trading Commission (CFTC) in the US. A good broker will offer competitive spreads, a reliable trading platform, and access to educational resources. Be wary of forex scams – always verify a broker’s regulatory status before depositing funds.

2. Open a Trading Account

To start, you will need to open a forex trading account with your chosen broker. Most brokers offer different account types depending on your experience level and capital. Many also provide demo accounts where you can trade currencies with virtual money, allowing you to practise without risking real capital.

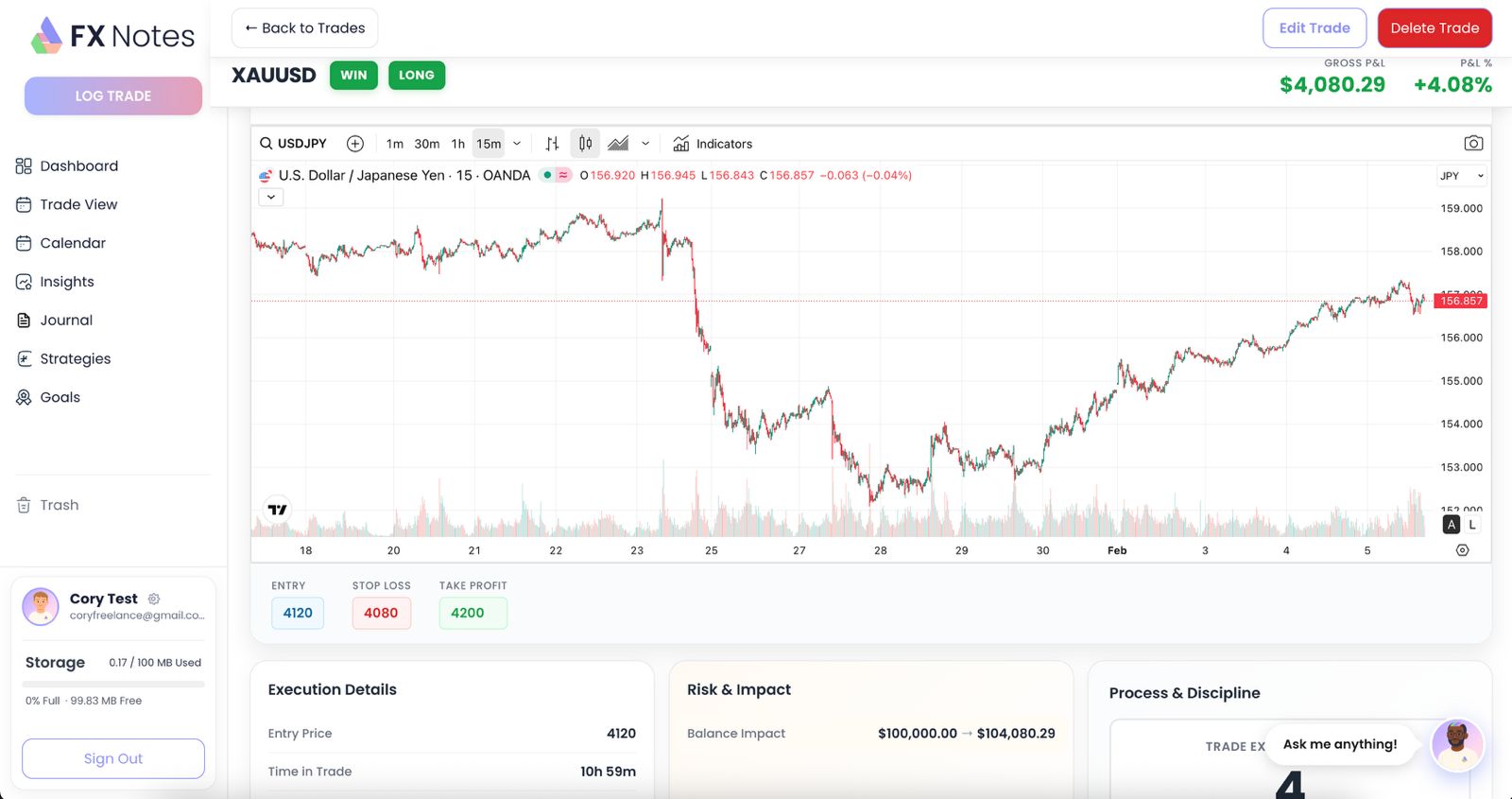

3. Learn to Read Forex Charts

Charts used in forex trading are essential for analysing price action and identifying trade setups. The three main chart types are line charts, bar charts and candlestick charts. At FX Notes, our journal lets you review your trade history alongside chart data, so you can see forex patterns and learn from every trade you make.

4. Start Small and Use Leverage Carefully

Forex leverage allows you to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses. Many retail investor accounts lose money when trading with excessive leverage, so it is crucial to understand the risks. We always recommend starting small and scaling up as your skills and confidence grow.

Some forex providers also offer access to other markets, meaning you can trade stocks, commodities and indices from the same account. This can be convenient if you want to diversify beyond foreign currencies.

Common Forex Trading Mistakes to Avoid

▼Even experienced traders make mistakes. Here are some of the most common pitfalls you should be aware of as you learn about forex and begin to trade.

Trading Without a Plan

Trading without a plan is one of the fastest ways to lose money in the forex market. Every successful forex trader has a defined strategy, clear entry and exit rules, and a risk management framework. Without these, you are simply gambling.

Over-Leveraging

Over-leveraging is another major risk. Just because your broker offers high leverage does not mean you should use it all. The most consistent traders use conservative leverage and focus on protecting their capital.

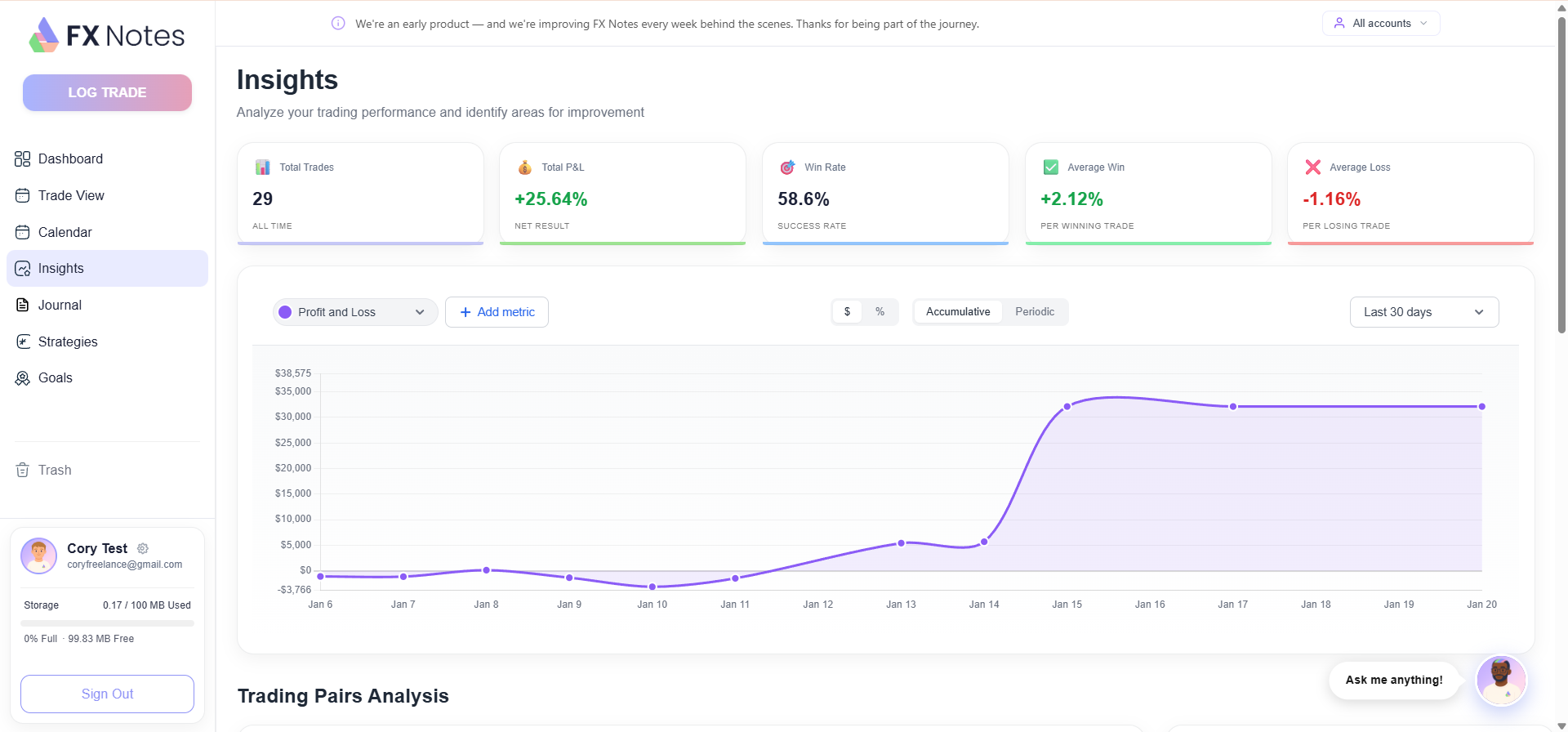

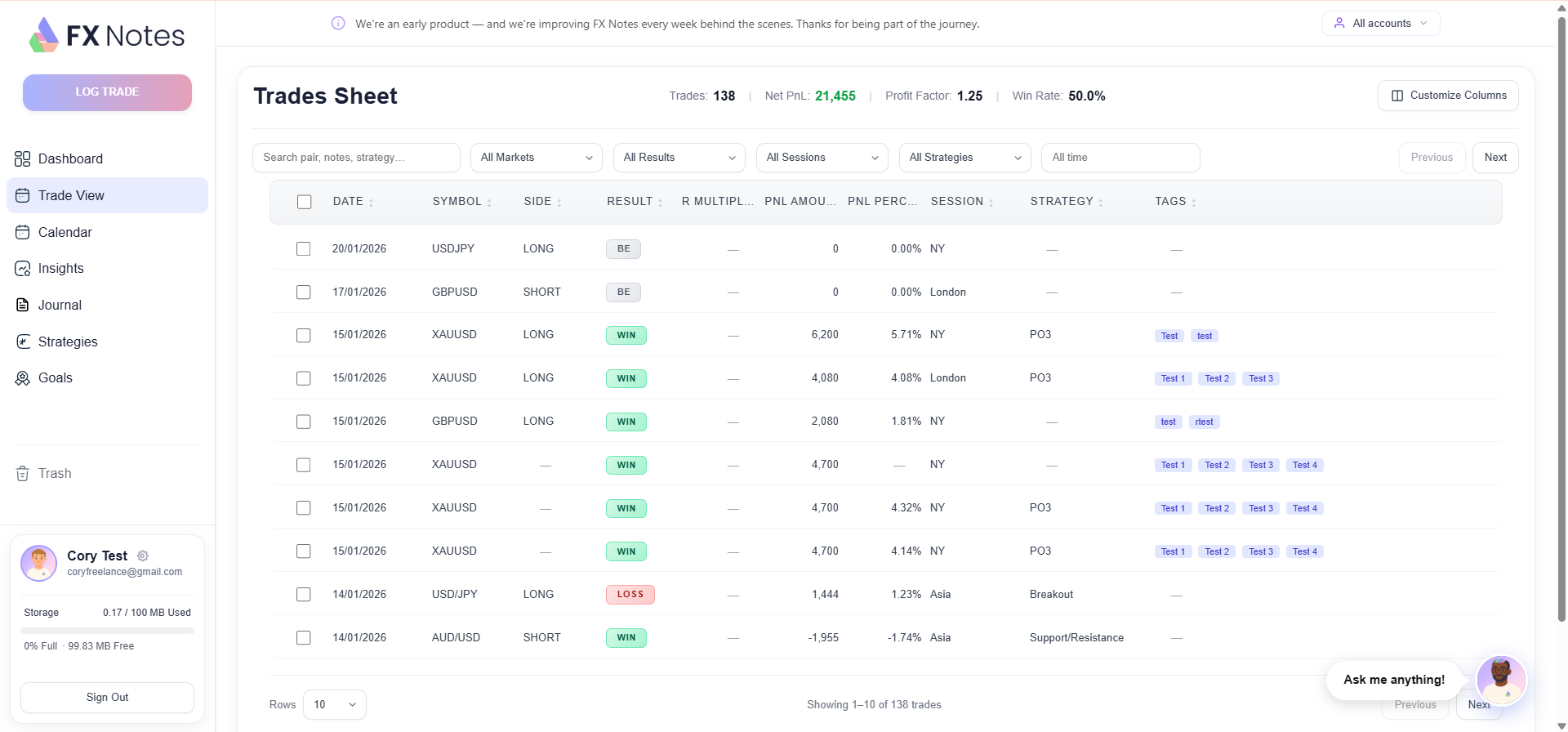

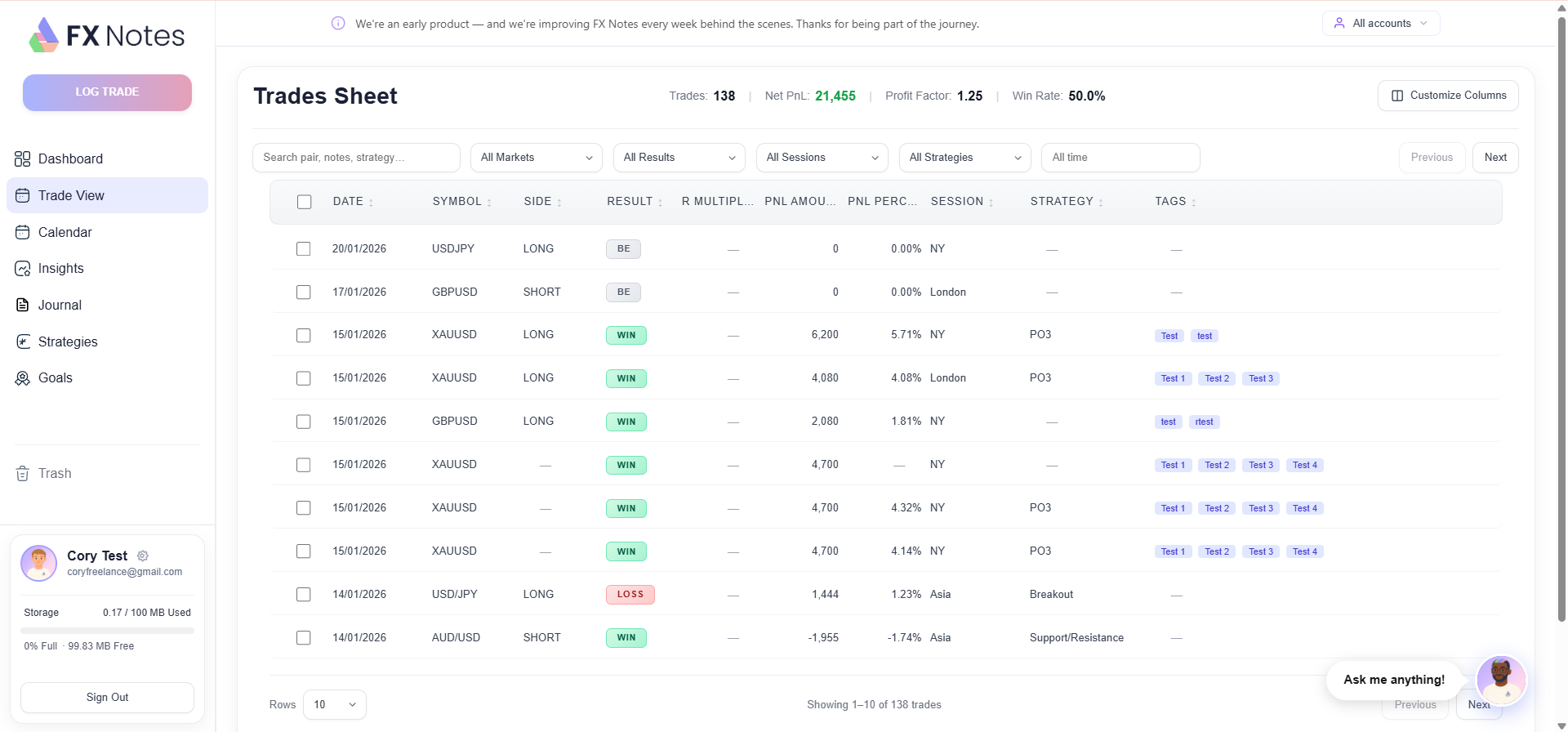

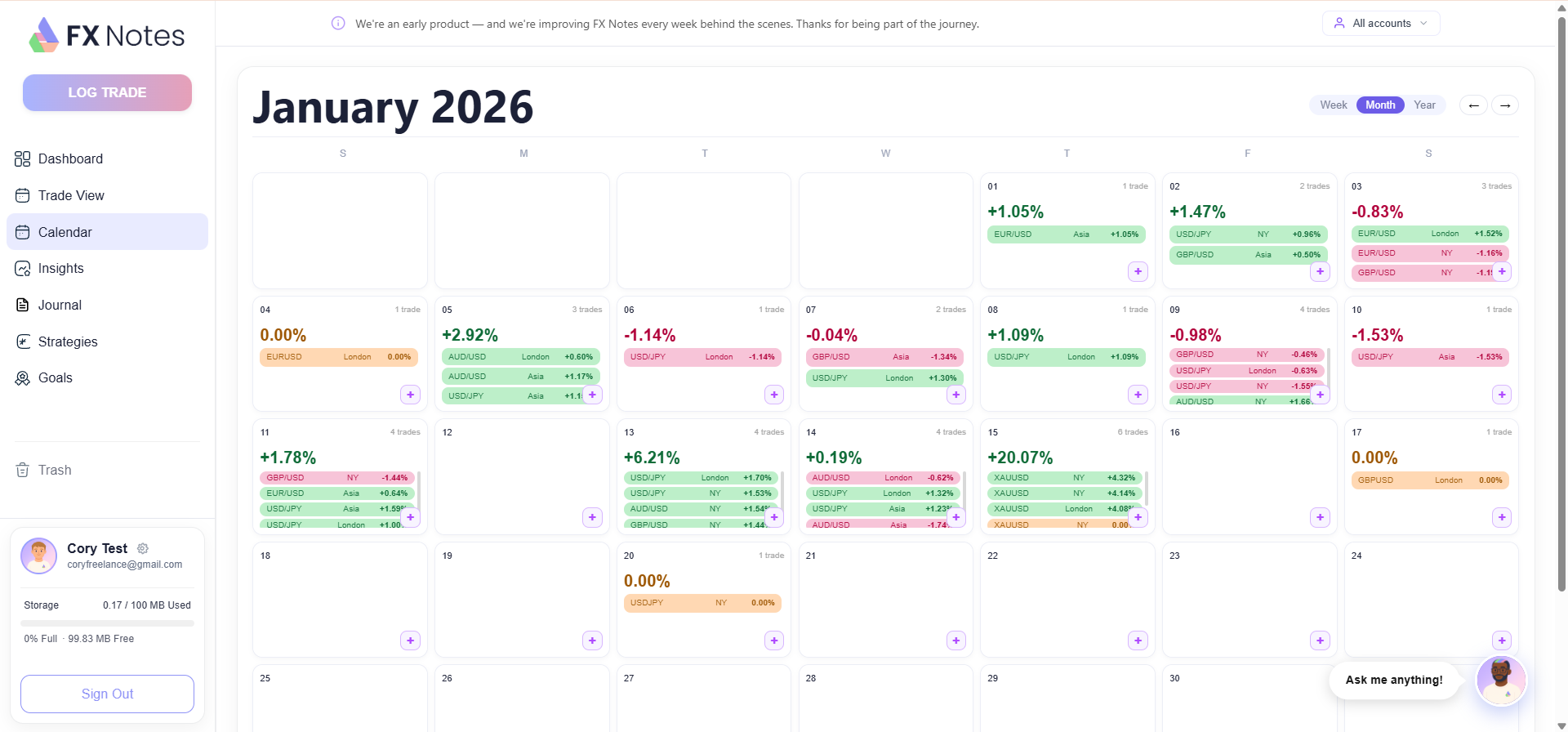

Ignoring Your Trade Data

Ignoring your trade data is a mistake we see constantly. If you are not recording and reviewing your trades, you have no way to identify what is working and what is not. This is exactly why we built FX Notes – to give every trader the tools to track, analyse and improve their trade performance over time.

Forex Risks, Regulation and Avoiding Scams

▼The forex market offers significant opportunity, but it also carries real risk. Understanding these risks is essential before you begin trading with real money. Many brokers also offer trading education and demo accounts to help you prepare.

Because the forex market is decentralised, regulation varies by country. In the UK, forex brokers must be authorised by the FCA. In the US, they fall under the oversight of the Commodity Futures Trading Commission and the NFA. In Australia, brokers are regulated by ASIC. Always check that your broker is properly regulated before depositing any funds.

Forex scams are unfortunately common, particularly targeting beginners. Be cautious of anyone offering guaranteed returns, “secret” trading systems or pressure to deposit money quickly. Legitimate forex providers are transparent about their fees, regulation and the risks involved. If something sounds too good to be true, it almost certainly is.

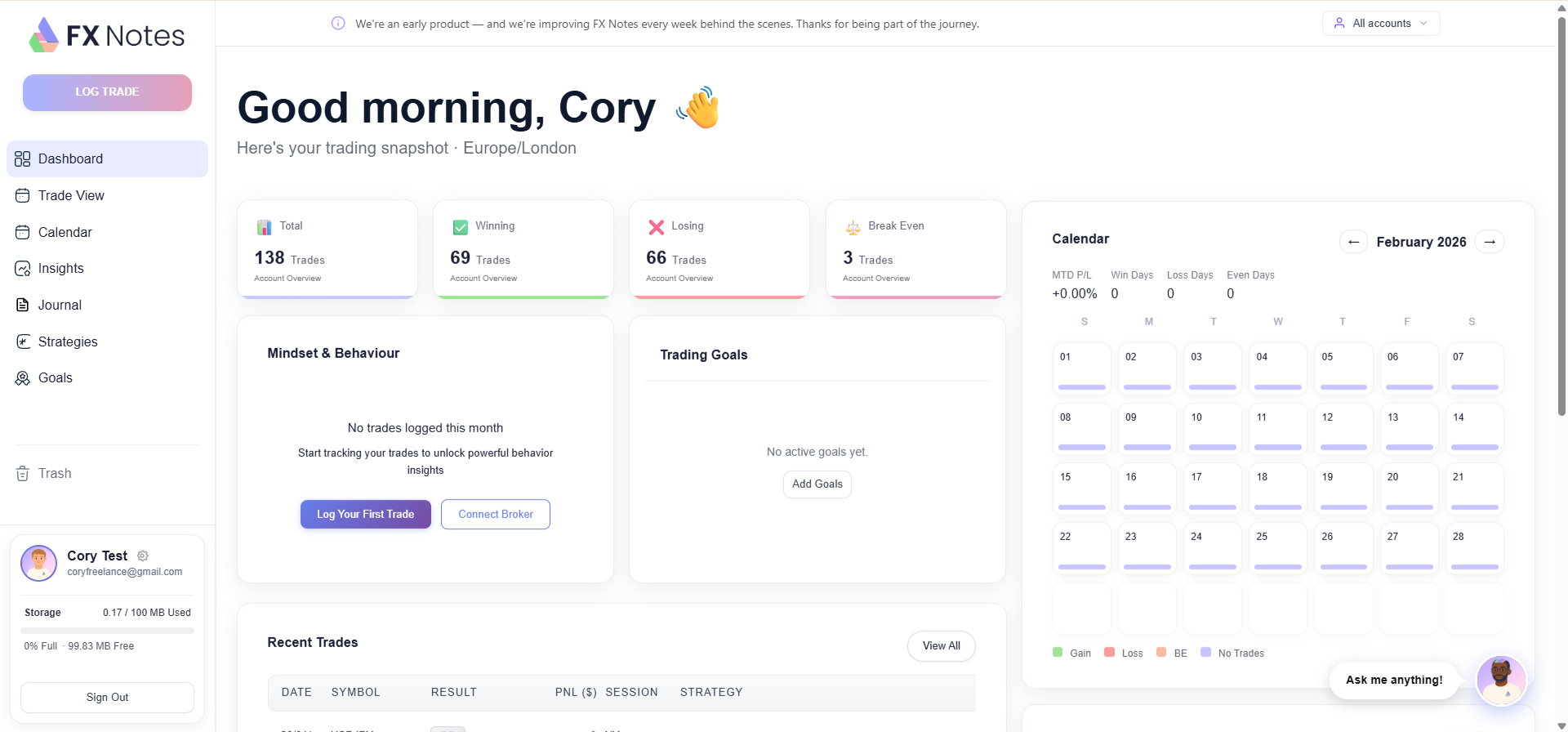

Remember that most retail trader accounts lose money. This is not meant to discourage you – it is meant to emphasise the importance of education, discipline and proper risk management. A trading journal like FX Notes helps you build those habits by keeping a detailed record of every trade and highlighting where your approach is strong and where it needs work.

Why Use FX Notes for Your Forex Trading Journal?

▼At FX Notes, we believe that journaling is the key to becoming a better forex trader. Our platform is built to help you become a forex trader who makes data-driven decisions rather than emotional ones.

We support forex, crypto and stock markets, so whether you trade foreign currencies, digital assets or equities, everything is recorded in one place. Our AI-powered analytics highlight patterns in your trading systems, help you spot setups you might have missed, and give you clear insights into how your strategies perform across different conditions and timeframes.

You can sync trades directly from your broker or exchange, so there is no manual data entry. Every trade is logged with full detail, making it easy to review your trading day, identify what went right and refine what did not.

Whether you are just starting out or you have been trading for years, a quality trading journal is one of the most valuable tools in any trader’s arsenal. It is not just about recording trades – it is about building a process that helps you trade better every single day.

Start Your Forex Trading Journey with FX Notes

▼The foreign exchange market offers incredible opportunities for anyone willing to put in the work to learn and develop a disciplined approach. Forex trading is one of the most accessible ways to participate in global financial markets, with the forex market open 24 hours and traded 24 hours a day from almost anywhere in the world.

Whether you prefer short-term or longer-term strategies, the key to success is continuous improvement. Use forex as a way to develop your skills, track your progress with FX Notes, and let your trade data guide your decisions. The best traders are not the ones who never lose – they are the ones who learn from every trade and adapt.

We built FX Notes to be the trading journal we always wished we had. It is fast, intelligent and designed around the way real traders work. Whether you trade forex, crypto or stocks, our platform gives you the structure and insight to trade with discipline. If you are ready to start trading forex with a proper system behind you, we are here to help you every step of the way.

Ready to take control of your trading?

All in one click, you can record, review, and improve. Start journaling and see the difference data-driven trading makes.